Industry Thought Leadership

Middle Eastern Telcos - Where is the Next Efficiency Frontier?

May, 2017Middle Eastern Telecom industry, is entering a new phase after a sustained growth period (over almost a decade). Annual revenue growth of 5-10% driven by a sustained increase in mobile penetration and low competitive price pressures are a history now. The current and emerging outlook in some markets is reminiscent of a maturity phase that Western European telcos have long been accustomed to.

As a result of continuous efforts to pursue market opportunities during this growth era, regional telcos have amassed complexities in their services, technologies and operational (processes, structures etc.) portfolios. These complexities are major drivers of costs and if addressed in a comprehensive manner can release 20-30% efficiency. For example, we observe that typically ~20% of the service portfolio contributes ~120%-140% of the telco’s margin, while the remaining 80% leads to erosion.

During the growth phase, regional telecom players have also pursued outsourcing models (e.g. Managed Services) to scale up their operations and to gain efficiency. However, such efforts have largely under-estimated the criticality of investing in internal capabilities required to steer and manage the suppliers. Resultantly, the region has very few examples of efficiency gains through outsourcing and it remains the most attractive and profitable market for telecom managed services suppliers. We estimate that telecom operators have an opportunity to reduce managed services’ costs by 25%-40% whilst improving service quality and operational efficiency.

Driven by the strategic imperative to shift to new frontiers of efficiency, as well as the available opportunities and approaches, telcos should consider transforming their operations to:

- Radically simplify services, technologies and operations portfolio

- Adopt a suitable network asset management model

- Rethink sourcing/contracting model across customer, IT and network

operations

- Exploit technology and infrastructure virtualization opportunities

- Digitalize operational processes

- Transform towards a lean and agile organization structure

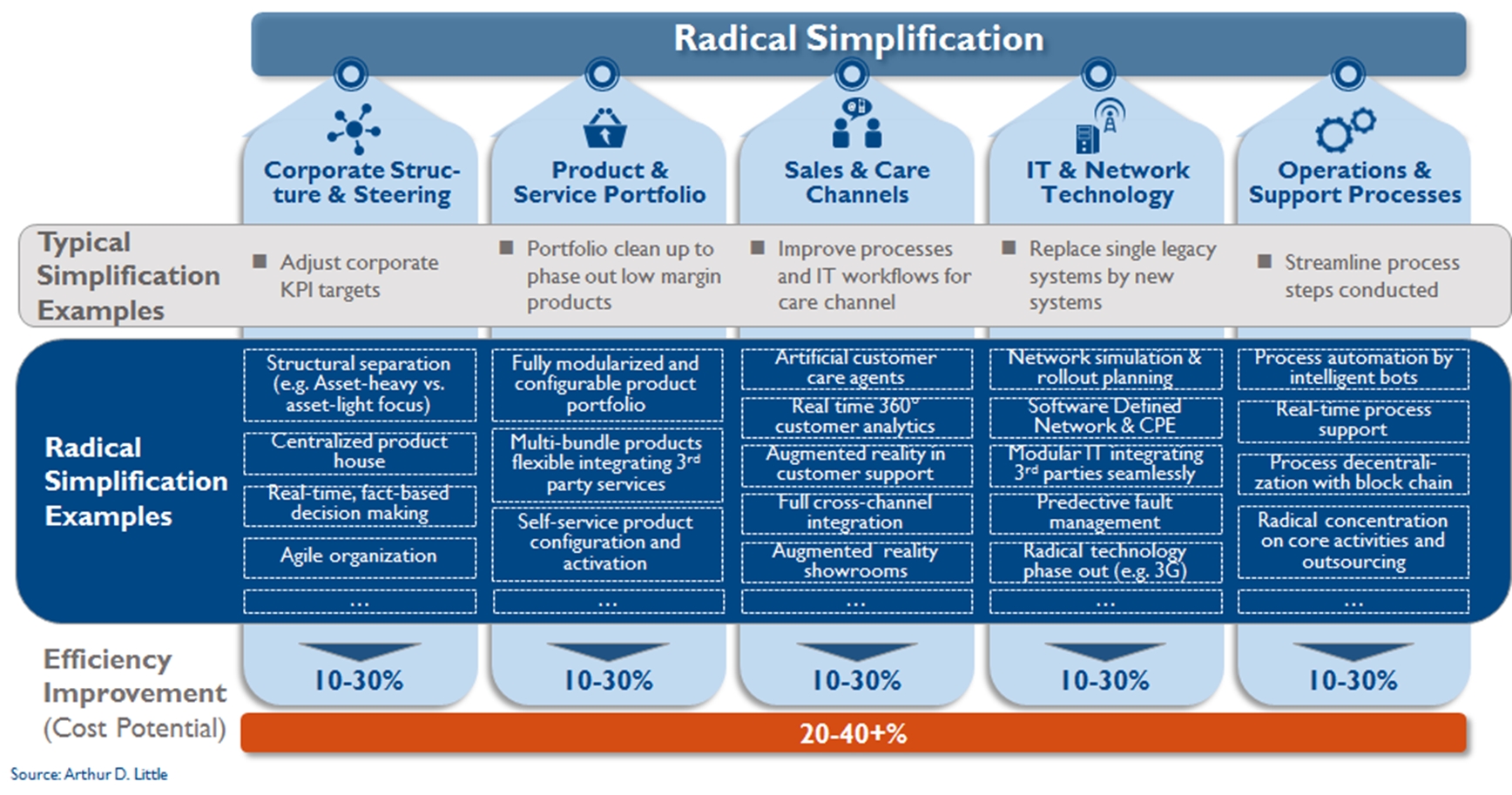

1. Radical Simplification of Operations

Radical (re)thinking of services, processes and technology portfolio is required for telcos to simplify their operations and successfully shift to a higher efficiency level. Telcos have an opportunity to simplify various operational areas, as shown in the table above (Arthur D. Little’s Radical Simplification Framework)

2. Network Asset Management Model

Globally, telecom players have adopted different configurations for Network assets management. These models can bring significant operational efficiencies in the regional context depending on the market specific strategic and regulatory context:

RAN passive sharing brings Capex benefits from lower site building costs and Opex benefits from lower site lease costs, resulting in network cost savings in the 10-20% range;

RAN active MORAN sharing generates Capex benefits from lower equipment investment needs and Opex benefits from lower operations and maintenance costs, resulting in approximately 30% savings in RAN costs;

RAN active plus Core active sharing additionally provides synergies in the area of transmission, resulting in total Opex and Capex savings in the 35-40% range.

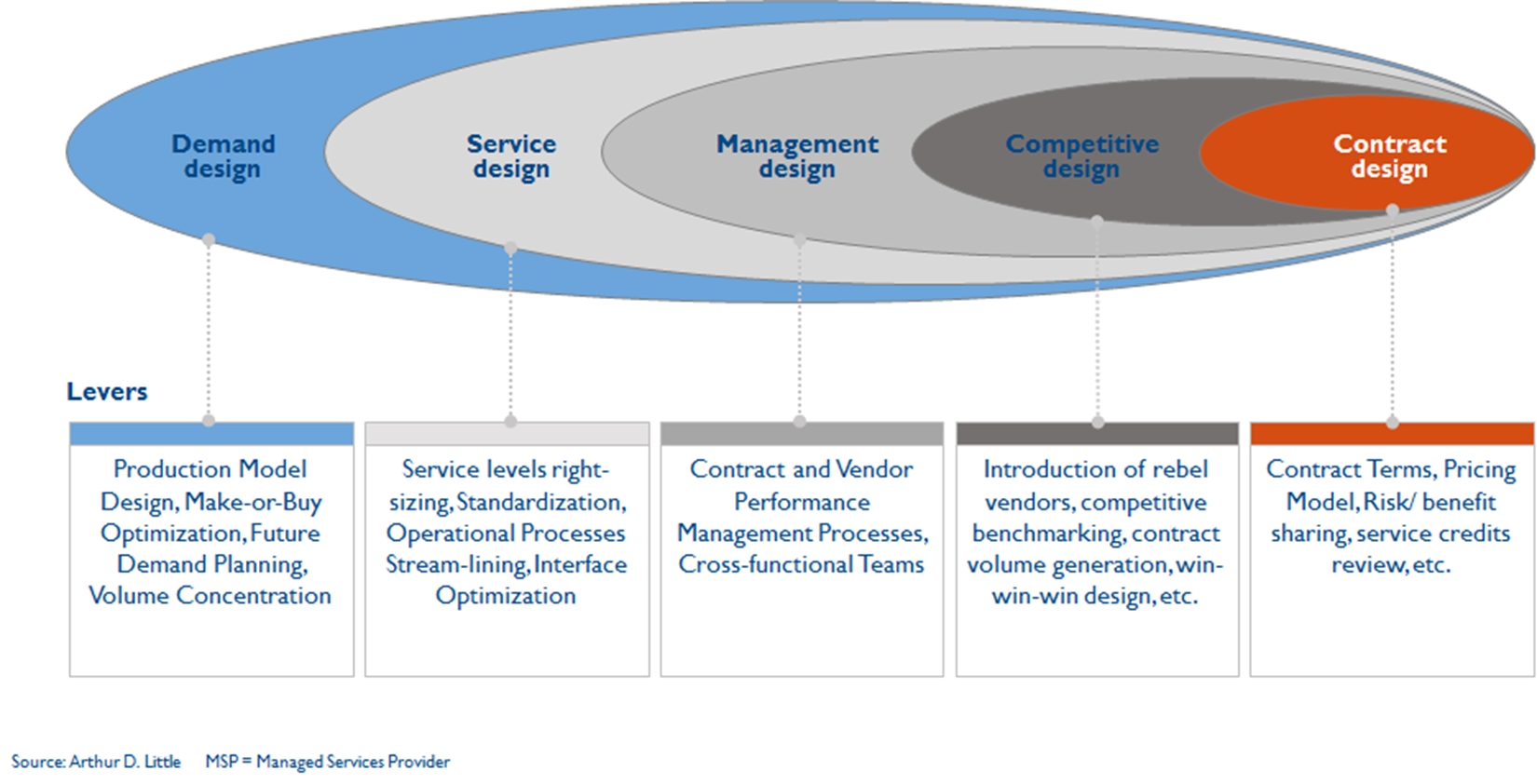

3. Sourcing/contracting Model

Telcos with an optimal sourcing model have a make-or-buy configuration that simultaneously optimizes time-to-market (technology growth), service quality (customer experience enhancement), operating risks and costs. Established telecom players which shifted towards outsourced model, have typically reduced Opex by 20-25%4, but such moves in the region have either failed to create the desired efficiency impact, or had other adverse side effects (e.g. negative impact on customer experience). Telcos should specifically build internal capabilities to steer and manage such outsourced operations. Specifically in Network operations, regional telcos have adopted a high level of outsourcing in both 1st & 2nd level support (67%) and Network field operations (85%), and are increasingly exploiting offshoring opportunities (38%)4. Beyond these moves, regional telecom players can streamline existing contract portfolio, through a comprehensive DSMCC approach (refer exhibit) addressing demand optimization and revising technical and business requirements in different functions viz. Network and IT managed services, call center activities, site rental and real estate management, etc. A multitude of benefits are achievable: from improved service effectiveness (e.g. service levels and time-to-market), greater corporate agility (flexibility and variabilization) to considerable cost savings (up to 20-30%);

4. Technology and Infrastructure Virtualization

Virtualization offers efficiency potential in multiple areas of technology operations as a result of automation, simplified operations as well as integrated management of processes.

Data center virtualization provides significant efficiencies compared to traditional physical data centers, in terms of reduced hardware and license costs, lower vendor lock-in, decreased energy consumptions, scalability, faster redeployment, easier backups, and allows operators to save capital and operating expenses.

NFV (Network Function Virtualization) and SDN (Software Defined Networking) enable operators to consolidate the different telecom appliances into standard industry servers, to reproduce the specific Network functions through partner-provided software (NFV) and to obtain automated and policy-driven control of dynamic network interconnections (SDN), which are instrumental to support virtualization. Various benefits achievable, include lowering needs to deploy and operate hard assets, improved visibility on network performance, higher degree of network security, and enhanced network flexibility and agility to roll out new services.

IT & Network architectural optimization and simplification can be obtained by performing a structured infrastructure technological audit and identifying rationalization opportunities coherent with current business delivery needs (value driven strategy); it allows to align technology strategy with corporate strategy, and to obtain significant Opex and Capex savings depending on the magnitude of the implemented optimization.

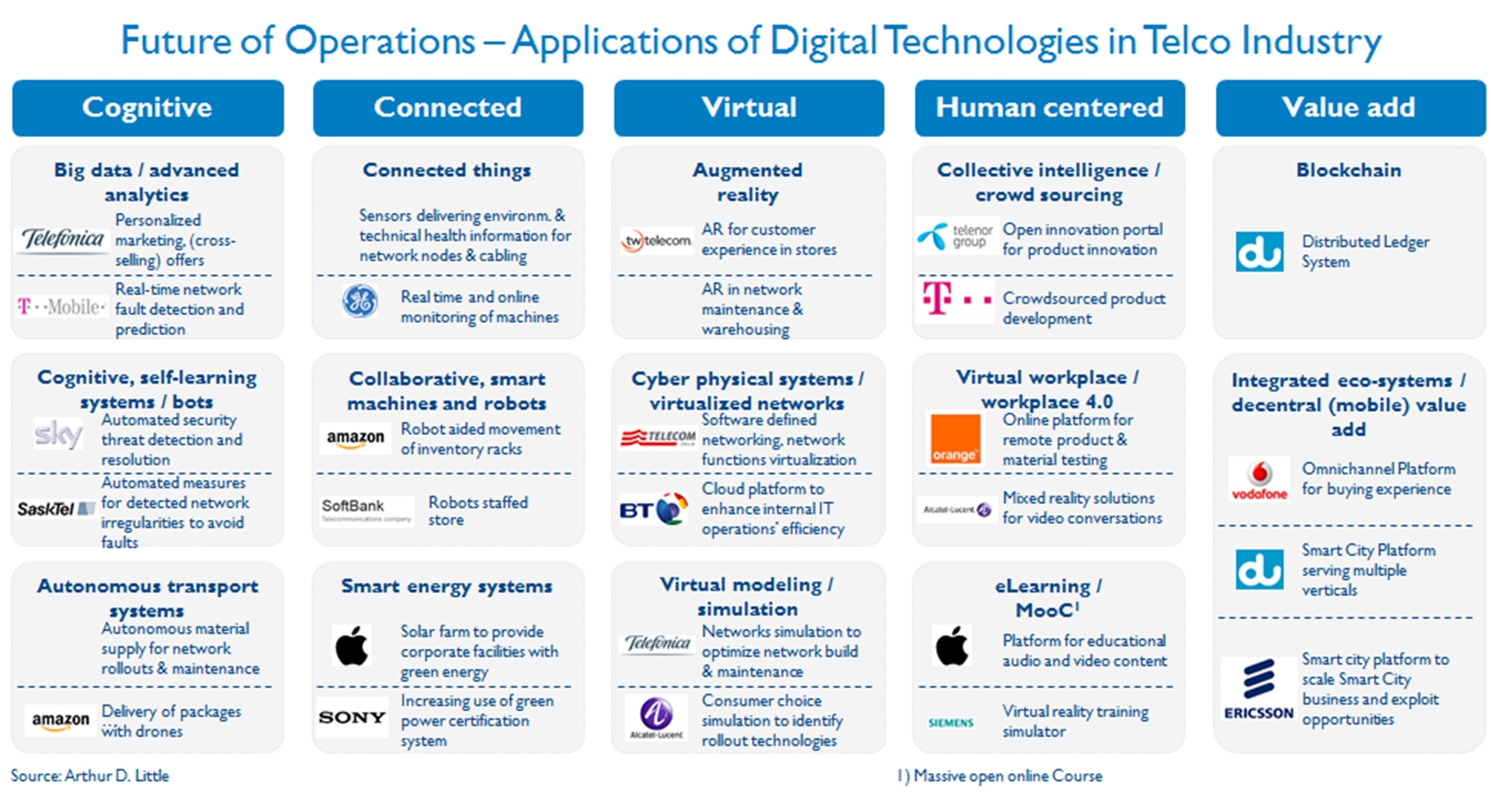

5. Digitalize operational processes:

Emerging digital technologies are driving disruptions in operations across several industries. Telecom operators can leverage these opportunities to drive operational efficiency. Exemplary applications of such technologies and their benefits include:

Network optimization using analytics – Network service quality is one of the key touchpoints affecting customer experience. Operators should leverage data analytics (combining network performance data, service usage data, customer demographics etc.) to optimize coverage and service performance and enhance customer experience.

Omni-channel platforms can help shift a significant part of customer interactions to digital channels while delivering a seamless and consistent experience across digital and physical channels.

Process digitalization, i.e. moving from traditional processes to digital, predictive and automated processes, can lead to significant efficiencies. For example, for which, according to a recent benchmark study , best performing Telco’s in terms of Network field operations can be 56% superior on cost driver averages and 35% on resources, in commercial processes (e.g. by reducing total cost to acquire and total cost to serve) as well as in inventory management (e.g. tracking performance, stock level monitoring).

Energy efficiency technologies can be leveraged to reduce power consumption in telcos’ operations: (1) cooling optimization can lead to 15-20% cost savings through free-cooling systems and advanced climate control systems that balance free ventilation and air conditioning (2) direct current (DC) system efficiency, by ensuring use of more efficient rectifiers , can generate 5-10% cost savings; (3) the employment of radio standby modalities (TRX shut-down) can also bring additional saving in the 5 to 10% range. For telecom operators running Networks infrastructure that include off-grid sites, significant efficiencies can also be obtained from the employment of hybrid solutions, like diesel-battery hybrid systems by reducing diesel consumption and diesel generator running hours.

6. Lean and agile organization

Legacy organization structures, processes and functional silos are widely attributed as key inhibitors of operational agility. It is becoming increasingly important for operators to reconfigure their organization structures. In our experience, through a zero-based design approach, operators can aim at a lean and agile organization with 40-50% lower headcount as compared to current scenario. Such improvement possibilities are further accentuated in case of regional operator groups who benefit from group wide consolidation of specific functions/activities. Furthermore, regional operator groups can generate additional opportunities in form of consolidated wholesale as well as procurement activities across OPCOs. However, the success of such consolidation initiatives are contingent upon effective Group-OPCO governance.

In conclusion, GCC telecom players are racing against time to shift to the next levels of efficiency to negate the effect of top-line pressures. They need to develop an effective operational engine to protect margins for future investments, regardless of the chosen strategic positioning. Conventional one-off cost-cutting initiatives are insufficient to deliver a sustainable and impactful push towards the next efficiency frontier. As one-off sessions of physical exercise are insufficient to provide positive results for individuals, a one-off cost cutting exercise is insufficient to instill a culture of agility and cost consciousness in telecom players. Regional telcos should consider a comprehensive transformation towards efficiency, through a range of approaches to address the inefficiencies arising from legacy commercial, technology and operational portfolios. Attaining sustainable competitive advantage through “Operational Agility and Efficiency” is a continuous effort which must be exercised over and over again, in a structured way, in order to embed it in the organization’s DNA.